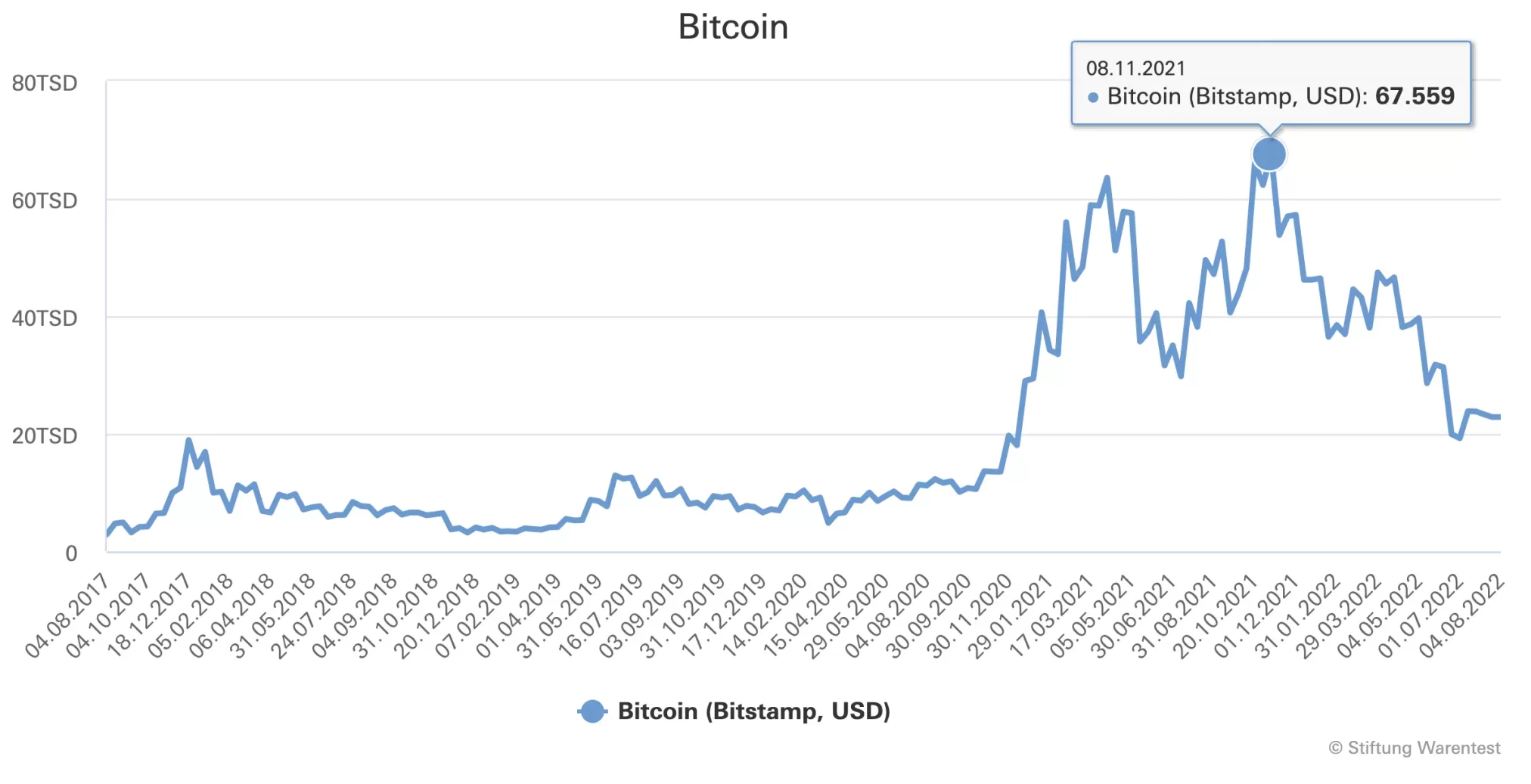

Bitcoins are popular, but extremely risky: In October 2021, the Bitcoin had marked a new all-time high of more than 66,000 dollars and more than doubled within three months. The hype is over for now.

Bitcoins have only existed since 2009. At the beginning of 2011, the Bitcoin rate was one dollar.

Tip: Our special Bitcoin: simply explained offers a brief introduction to the subject of Cryptocurrency.

The chart shows how Bitcoin has developed over the past five years.

We invite you to try the best bitcoin casinos, we have specifically selected them with this feature in mind!

Virtual bitcoins managed in the blockchain

The term Bitcoin is made up of the word for the smallest digital unit, the bit, and the English word coin for coin. A certain Satoshi Nakamoto is responsible as the inventor – although it has not yet been clarified who is the brain behind it. This may be a group of people.

Bitcoins, BTC for short, are neither coins nor bills. They only exist virtually, as a digital character string. Even if they are often compared to gold: there is no real value behind them. New Bitcoins are created by the users themselves using mathematical processes. The balances and payments are managed in a decentralized network, the blockchain.

In order to book a transfer with bitcoins, complicated calculations have to be solved. Whoever manages to do this first gets bitcoins as a reward.

Bitcoin – you should know that cryptocurrency.

- Real, decentralized cryptocurrencies that are mined and traded using blockchain technology are not dubious per se. However, speculating on Bitcoin and Co is like going to the casino (buying and mining Bitcoin). Only use money you don’t need. You can lose everything.

Initial coin offering. - Buying tokens and other “vouchers” that companies sell to raise capital is far too fraudulent and risky. Better keep your hands off it. More on this in our special Cryptocurrencies: Coins and tokens – speculation or swindle?

crypto assets. - Special crypto investments: The risky world of Bitcoin & Co shows how the crypto world works in relation to investments and non-fungible tokens (NFTs).

The dark side of bitcoin

In the past, bitcoins were primarily used as a currency for dealers who used them to trade in weapons and drugs on the dark web. Literally translated, Darknet refers to the dark side of the Internet, where users can surf largely anonymously.

Bitcoin also made headlines in connection with ransom demands.

At 21 million Bitcoins it’s over

So far, according to the website Coinmarketcap, there are a good 18.8 million Bitcoins, with 21 million to be the end. However, growth continues to slow down. You can also trade fractions of bitcoins, for example millibitcoins.

Significant Events

- Bitcoin price development from 2009 to 2021.

- January 2009: Genesis block: Satoshi Nakamoto himself starts the Bitcoin blockchain. It has been running for 13 years with no major problems.

- May 2010: In Florida, programmer Laszlo Hanyecz receives two pizzas for which he pays 10,000 Bitcoin.

- February 2011: The price of bitcoin reaches one dollar. By June it will rise to almost $30 – a plus of 3000 percent.

- December 2013: Bitcoin breaks through $1000 and hits an all-time high of $1237.

- February 2014: Mt. Gox, the largest bitcoin exchange to date, collapses, dragging the bitcoin price down.

- January 2015: After a very weak year, Bitcoin is around 300 dollars at the beginning of 2015.

- December 2017: A huge increase within a few weeks brings Bitcoin to a new all-time high of $19,345.

- December 2018: The boom is followed the year after by the price falling to just over $3000.

- July 2019: The price recovers and rises to almost $12,000.

- March 2020: Corona shocks the world and Bitcoin falls to $5000.

- February 2021: Elon Musk lets the US electric car manufacturer Tesla buy Bitcoin for 1.5 billion dollars – the price rises.

- September 2021: The new high of $67,000 is reached. Twitter introduces bitcoin payments.

Beware of falling and theft

Anyone who enters the world of cryptocurrencies does not only have to deal with extreme price fluctuations. The reasons for this are often not easy to understand. Sometimes the closure of bitcoin exchanges or the fear of state regulation play a role. Time and again, digital money comes under pressure because hackers have cleared a platform. Anyone who stores bitcoins on their private computer should also protect themselves against theft.

2021 was a record year for cryptocurrency scams. According to a report by the analysis company Chainalysis, a total of 7.8 billion US dollars were stolen from users. Pure cryptocurrency theft rose over 500 percent year-on-year to over $3 billion. Cryptocurrencies are stolen by hackers from crypto exchanges, such as BitMart in 2021, or private wallets. 2.8 billion dollars are due to the relatively new type of fraud “rug pull”.

Supposed developers pretend to create cryptocurrency projects. To do this, they collect money from investors and then disappear. The biggest case of fraud goes back to the Turkish Internet platform Thodex, where the founder evaded investors with a lot of money.

Buy and mine bitcoins

If you are looking for a thrill and want to become a Bitcoin owner, you have various options.

- Bitcoin wallet – The classic variant is to get a bitcoin wallet, an electronic purse in which the bitcoins are stored. There are various providers for this. The wallet has a public account number and a private key that can be used to lock it. Investors should secure their computer well so as not to become a victim of theft.

- Bitcoin account – Another option is to set up an account with one of the numerous bitcoin trading platforms. In this case, the bitcoins are not stored on your own computer or mobile phone, but on the platform.

Tip: Bitcoiners should pay attention to a fair price and – importantly – the costs. There was a time when a transaction cost more than $30.

Mining – a computationally intensive task

Bitcoin payments must be confirmed. For example, it must be clarified whether the person making the payment actually has enough bitcoins for it. In addition, the new data blocks with the current payments must be linked to the previous data blocks of the blockchain. To do this, certain arithmetic problems must be solved. Anyone who does this and confirms payments gets bitcoins as a reward. This is called mining. The miners not only need technical know-how, but above all the appropriate computer equipment.

The demands on computing power are now so high that it is almost impossible to get involved on your home PC. Unlike in the early days, mining is therefore largely in the hands of mining pools or companies founded specifically for this purpose.

Bitcoins as a climate killer

With the demands on the technology, the energy consumption also increases. Years ago, in an interview with the Handelsblatt, the Bundesbank referred to calculations according to which a single Bitcoin transaction corresponds to the monthly electricity consumption of a single-family household in Germany. Eco-friendly is different.

Offers from brokers and exchanges

Recently, the well-known fintech Scalable Capital created its own crypto trading section. Investors can buy so-called Exchange Traded Products (ETP) there. Although the abbreviation is similar to that of ETF (Exchange Traded Funds), it is – like ETC – bonds. The ETP are deposited with the respective cryptocurrency, says Scalable. Savings plans with ETP are also possible.

Investors can also buy cryptocurrencies from neo-brokers such as Trade Republic or Justtrade. Trade Republic and Justtrade work with third-party providers to store Bitcoin. The crypto money is held in trust there, and there is insurance against theft. Investors can also buy ETPs at Binance or other trading resources.

Legal tender in El Salvador

In early September 2021, El Salvador introduced bitcoin as legal tender. The residents of the Central American country can now pay for their daily purchases with Bitcoin and also transfer their taxes in the digital currency. The state had its own app programmed for this. Vending machines are already set up.

Public acceptance has so far been moderate given the strong fluctuations. However, payments in bitcoin could save Salvadorans, many of whom work abroad, money transfer fees. It is possible that people without a bank account will now be able to access the banking system – provided they have the technical equipment.

Conclusion

It is these funds, held in stocks, real estate, gold and accounts, that Bitcoin could attract. Money that is intended as a provision for the future, the money of savers, so to speak. Anyone who used to invest in real estate with a long-term perspective could now do so with Bitcoin – which would even have the positive social side effect that more apartments would become available again on the housing market. The market is now giving bitcoin a value.

However, there is a problem: This value is anything but constant. The course goes up and down; and for Bitcoin to be used in everyday life in the long term, more stability is needed. The market must grow for this, then Bitcoin could become a complement to other assets. And maybe there will come a moment when people will use this new currency without even thinking about it. Just like they do with the dollar or the euro today. Only then with new, digital money, in a new, digital world.

Be the first to comment